Long Island City Skyline (Photo: Queens Post)

Aug. 13, 2019 By Christian Murray

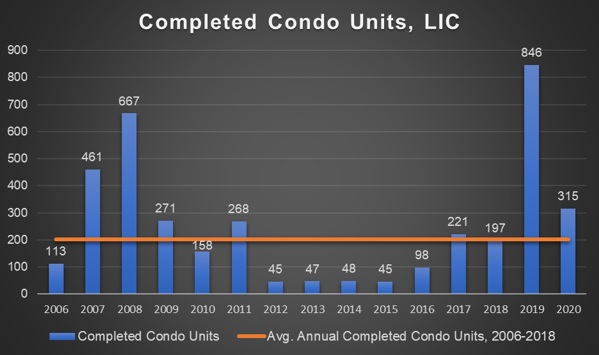

The supply of condos in Long Island City has reached a record high and it could take years before the market absorbs them all, according to a new study released by a local real estate consultant.

More than 1,100 new-development condos are currently for sale in Long Island City and hundreds more will become available over the next year, according to the study. The number is particularly large considering that approximately 2,500 condos were built in Long Island City between 2006 and 2018.

The booming supply means there are a lot of buildings for buyers to choose from. Most of the units in these buildings are currently in construction.

“This is a great opportunity for buyers because there is a wide selection of floor plans, price points and locations available,” said Patrick W. Smith, a real estate consultant and broker who has tracked the Long Island City condo market since its inception and conducted the study.

Smith’s report defines Long Island City as 41st Avenue to the north, Borden Avenue to the south, the East River to the west and Skillman Avenue to the east.

Smith’s report revealed that there were 538 unsold condo units in 23 newly-developed buildings as of July 31, 2019– excluding the massive Skyline Tower at 23-15 44th Drive that has recently hit the market.

That building, the tallest in Queens at 67 stories, contains 802 units, with about 600 still to be sold. The building currently accounts for about half the available supply in the area.

Additionally, there are eight developments in the pipeline that will contain about 315 condo units, according to Smith. These units are likely to hit the market from now through the end of 2020.

The amount of time it will take for buyers to absorb the supply is not easy to gauge.

Historically new condos have sold at a pace of about 20 units per month, according to Smith’s analysis based on city and public records.

In 2018, 283 condos sold in Long Island City, with 191 of these being new development, according to Smith’s findings based on transactions recorded with the city. The number of new development sales equated to 16 per month, while the resale market came in at eight per month.

However, these numbers appear to have picked up. Smith’s analysis—excluding Skyline Tower—indicates that 26 contracts have been signed on average each month for new condos since Feb. 14, the date Amazon announced its withdrawal.

However, that number is less precise than transactions recorded with the city, he said, since it is based on when developers decide to report a contract signing. Developers are able to report contract sales at a time of their choosing or not at all, he said.

The Skyline Tower, which has striking views and an extensive amenity package, has seen 200 units of its 802 units sell since it got the go-ahead from the state attorney general’s office to start selling units after Oct. 12. That would equate to a little over 21 sales per month.

Modern Spaces, which has been exclusively handling marketing and sales for the Skyline Tower, however, said Thursday that the 200 sales ($223 million worth of inventory) were made since its soft launch in May—equating to an absorption rate of about 80 units a month.

The company also noted that when it opened its official sales gallery on July 11, nine sales were made on the spot. The day-of sales ranged from $640,000 to $2.4 million.

Smith, who does not represent Skyline Tower, believes the building will continue to sell because of its unprecedented height, views, amenities, location and value as compared to similar properties in Manhattan.

Quality condos will continue to perform well, Smith said. He noted that prices are remaining firm throughout the area despite the growing supply.

Developers are not feeling price pressure since most of the new buildings that are on offer are still under construction and not ready for occupancy, he said.

Smith said that condos priced below $1.2 million have historically been in demand. He anticipates that this will continue and that the pressure is likely to come on units listed at higher price points.

No matter, Smith says the main drivers for the Long Island City condo market remain intact. Area condos, for instance, continue to sell at a discount compared to Manhattan.

Furthermore, he noted, the area has an excellent transportation network, a commercial sector that continues to grow, waterfront parks and safety.

Note: The chart above excludes 802 units at Skyline Tower, 23-15 44th Drive. The number of condo units shown for 2019 and 2020 are based on units that have received or that are anticipated to receive their temporary certificate of occupancy in 2019 or in 2020. Source: Patrick W. Smith | The Smith Report

To access the full report, click here

3 Comments

The music will stop one day and it won’t be pretty.

Wondering how Mass transit will keep up once all dwelling are occupied.

Mass transit can’t even hold up now…