Development activity in Court Square from 44th Drive (Queens Post)

April 8, 2021 By Christian Murray

The Long Island City condo market saw a frenzy of sales activity in the first quarter of 2021, with buyers coming to the market at a rate more pronounced than the weeks that followed the November 2018 Amazon announcement.

There were 191 signed deals for the Jan. 1, 2021 through March 31 period, according to Patrick W Smith, a Long Island City new-development specialist who analyzed the listings data.

This number was up from 86 for the same three-month period in 2020, and surpassed the 98 deals that were inked during the first quarter of 2019.

The first three months of 2021 even outpaced the Amazon euphoria. Between Nov. 5, 2018 and Feb. 14, 2019 — when Amazon was expected to open a headquarters in Long Island City only to back out — 147 sales contracts were signed.

“With the vaccine rollout, there is a growing confidence among buyers in Long Island City and we saw this as the number of transactions in the first quarter easily surpassed the Amazon period,” Smith said.

“Long Island City’s waterfront parks, new schools, our small-town feel, low interest rates and much greater affordability, as compared to Manhattan, are what’s motivating buyers today.”

.

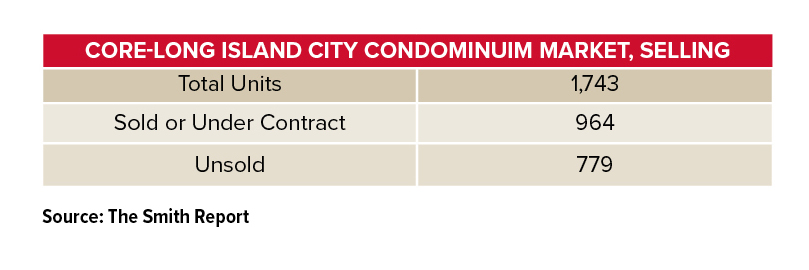

Smith also analyzed the number of unsold condo units in the area — noting that if the pace of sales continues, the market would be able to absorb any perceived new-development glut.

His analysis indicates that there are 779 unsold condominium units in the new-development market, with 558 of those contained in two large Court Square buildings. Excluding those two buildings, there are 221 units that remain unsold contained in 14 buildings. Those projects are 71 percent sold out on average, he said.

.

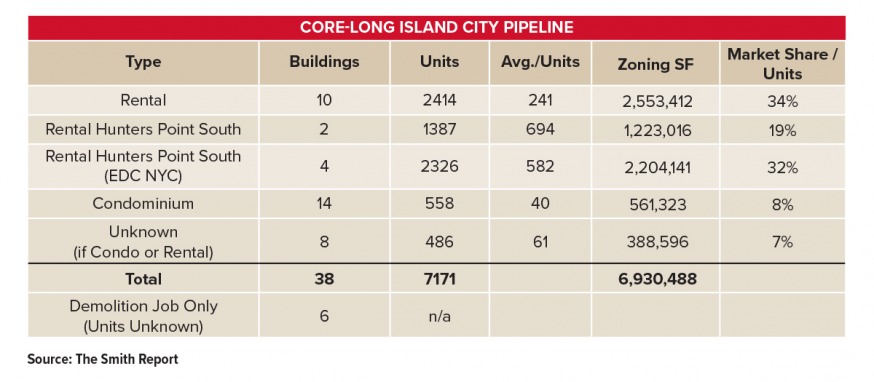

Smith notes that there is not a big pipeline of condos about to enter the market. His analysis, based on Dept. of Buildings filings and the Attorney General’s database of condo offering plans, indicates that most of the buildings that will be completed in coming years will be rentals.

He calculates that there are 7,171 residential units in the pipeline that are likely to be completed over the next four years.

Smith says that only 558 of the 7,171 units are going condos, with 51 percent of those being in the Tavros building at 45-03 23rd St. in Court Square.

His analysis excludes buildings that have already been issued with a temporary certificate of occupancy (or certificate of occupancy), such as the 1,122 unit-5 Pointz rental development. It also excludes projects where a developer has not made a filing with the Dept. of Buildings since Jan. 1, 2019, viewing such a project as being on hold.

“There are only 558 condominium units in the pipeline that are anticipated to come to market over the course of the next few years, and many of the existing new developments are rapidly approaching at least 70 percent sold,” Smith said.

“We could see an undersupply of condominiums that is not dissimilar to the years following the Global Financial Crisis when only 551 condominium units were completed in LIC from 2011 through 2016.”

.

For additional information, please click here