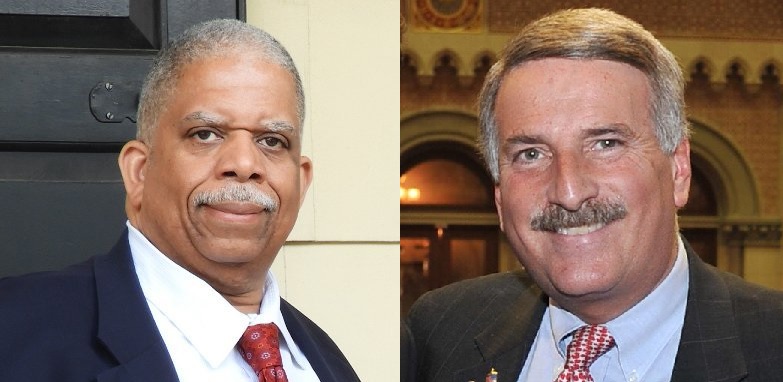

NYS Senator Leroy Comrie and Assemblyman David Weprin (Twitter Photo)

Aug. 27, 2020 By Allie Griffin

Two Queens lawmakers have introduced legislation that aims to block the de Blasio administration from holding its up-coming lien sale to help struggling homeowners at risk of losing their homes.

The administration’s annual lien sale is set for Sept. 4, after being postponed from its original May date due to COVID-19. The city will auction debt on tax-delinquent properties to private debt collectors.

State Sen. Leroy Comrie and Assembly Member David Weprin have introduce a bill that would bar the city from holding a lien sale until at least one year after Gov. Andrew Cuomo lifts the emergency order declaring that the pandemic is over.

The two lawmakers hope their bill to delay the lien sale would give people more time to get on their feet following the employment turmoil caused by the pandemic.

The city sells liens to debt collection companies that put together a payment plan–that includes interest– with property owners. If the property owners fail to pay they risk losing their property.

“The tax lien sale can’t happen this year, and I’m going to raise hell between now and Sept. 4 to see to it that it doesn’t,” Comrie said in a statement.

His Southeast Queens district, which is still recovering from the mortgage crisis, has as many as 600 homes eligible for this year’s lien sale.

He said the pandemic has prevented at-risk homeowners from being able to address their tax delinquency. COVID-19 has also made it difficult for the senator’s office to work with the Department of Finance to identify and assist those at risk of losing their homes, as it has done in years past.

“Homeowners facing the lien sale need ample time to consult with attorneys, enter into payment agreements [with the Dept. of Finance], and learn about exemption programs ahead of the sale,” Comrie said. “COVID-19 has made this all but impossible to do on the scale that we need it to happen.”

Comrie introduced the bill in the senate on Aug. 19. Weprin is the Assembly sponsor.

“With thousands in our city struggling with the economic effects of the COVID-19 pandemic, including many homeowners in my Assembly district and across Queens, it is absolutely unconscionable to hold the tax lien sale in 2020,” Weprin said in a statement.

Housing advocates praised the lawmakers’ legislation and said the lien sale needs to be postponed.

“Now is not the time to amplify housing insecurity in communities of color or among seniors,” said Ivy Perez, spokesperson for the Coalition for Affordable Homes, which represents over 30 affordable housing advocacy organizations.

“Those same communities, most of them low- or moderate-income, have been hardest-hit by COVID-19, and the tax lien sale threatens to further destabilize them.”

Property owners who owe money currently have until Sept. 3 to pay their debts or enter into a payment agreement with the Department of Finance to avoid being part of the lien sale.

One Comment

I hope and pray this passes.